Global shipping giant Maersk said on Monday there are signs of further congestion at ports around the world, especially in Asia and the Middle East, as the chaos caused by the Red Sea crisis continues due to strong demand in the container market. Singapore is one of the world's busiest ports and a major transit hub in Asia, and recent congestion at the port has raised concerns in the industry.

Singapore is the world's second largest container port, and the recent serious congestion in Singapore's port has caused concern in the industry. According to a recent report by Linerlytica, an Asian container consultancy, container ships in Singapore may have to wait up to seven days for a berth, compared to a normal half day.

The latest figures show a surge in the number of containers waiting to be docked in Singapore in May, with a peak of 486,600 20-foot standard containers in late May.

The Maritime and Port Authority of Singapore said in a recent report in response to the media that there are two main reasons for Singapore's port congestion: shipping delays and a surge in container throughput.

First, the Red Sea crisis caused ships to detour around the Cape of Good Hope in Africa, disrupting the planning of major ports around the world. Many ships were unable to arrive as planned, and when unscheduled ships arrived at ports, there were queues, resulting in a "ship clustering" effect.

Secondly, according to the Maritime and Port Authority of Singapore, there has been a noticeable increase in the number of vessels arriving in Singapore so far this year. In the first four months of this year, Singapore handled a total of 13.36 million TEUs, up 8.8 per cent year-on-year.

新加坡海事及港务管理局还表示,集装箱处理量的增加,部分原因是一些航运公司为了赶上下一班次的时间表,放弃了后续的航程,将东南亚国家的货物集中卸在了新加坡,船舶靠港装卸的时间也因此拉长。

To ease congestion, port operator PSA Singapore said it has reactivated old berths and shipyards at Keppel Terminal in Singapore that had previously been decommissioned, and increased manpower. Following the new measures, PSA said the number of containers it can handle per week will increase from 770,000 TEUs to 820,000.

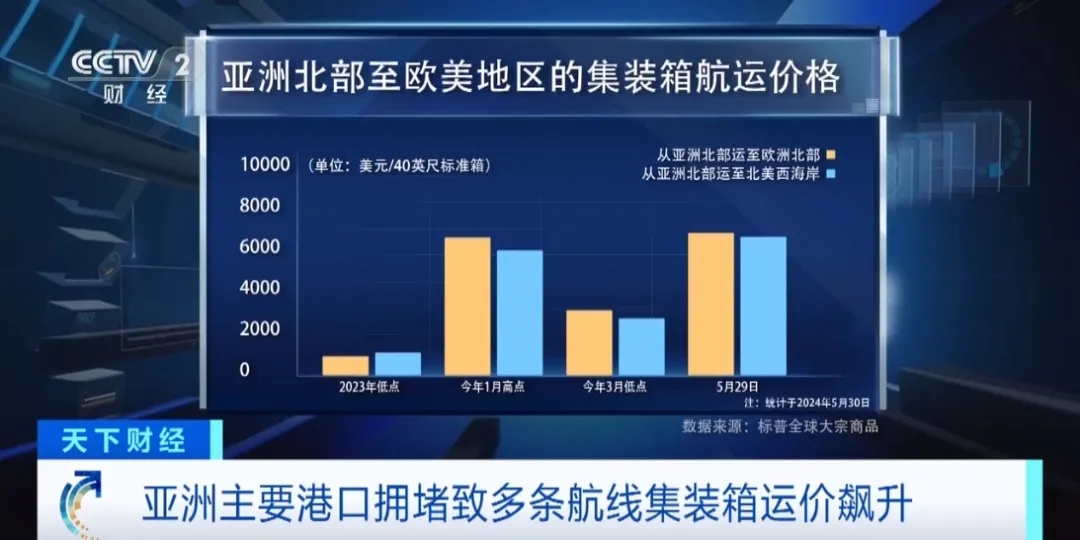

The latest report from S&P Global shows that congestion at major Asian ports, especially Singapore, has also contributed to higher container shipping prices.

As of May 30, Asia-to-Europe freight rates are now $6,200 per 40-foot container, while Asia-to-North America West Coast freight rates have climbed to $6,100.

The global supply chain is facing several uncertainties, including the geopolitical crisis in the Red Sea, the frequent occurrence of extreme weather around the world, which can cause shipping delays, and the risk of strikes. The S&P Global report points to a possible strike by Canadian customs border agents in June, as well as strikes at U.S. East Coast and Gulf Coast ports when contracts expire this fall.